Cookies help us to enhance your experience. By using the website for Adsum software, you consent to the gathering of data as set forth in our Cookie Policy.

Secure Mobile Banking App Development: Steps, Features & Trends

Are you a financial institution or company looking to expand your customer base internationally? Then you should invest in mobile banking app development. With the rise of mobile banking apps, users can now do their banking activities effortlessly from any location at any time, eliminating the need for traditional banks.

With a projected CAGR of 16.8 percent from 2023–2032, the worldwide mobile banking business is expected to grow from $1.5 billion in 2022 to $7 billion in 2032. So, by seeing this data it is clear that investing in mobile banking apps can be fruitful for business.

So, this blog will cover everything from steps, features, challenges and so on to develop a secure mobile banking app.

Table of Contents

What is Mobile Banking App Development?

Mobile banking app development is the creation of banking apps that let users conduct banking-related tasks on their mobile devices. It lets users check their account balance, move money between accounts, pay bills, and do other monetary tasks.

It’s also very important to have safety, and encryption methods are used to keep private data safe. Mobile banking app developers create apps that protect private monetary data with secure encryption algorithms.

Why Is Investing In A Mobile Banking App Development Beneficial For business?

Developing mobile banking apps makes it easier for customers to interact with banks and use their services, which builds trust and confidence. It speeds up deals, lowers costs, and grows the market, which automatically drives businesses expansion in the digital age. This is the reason why businesses should invest in mobile banking app development. The mobile banking sector exceeded $1.3 billion last year and is expected to triple by 2030, growing at a CAGR of over 15%. According to a study, affordable custom apps starting around $150,000 are accelerating this rapid market expansion.

To make your doubt more clear, let’s have a look at the below market condition.

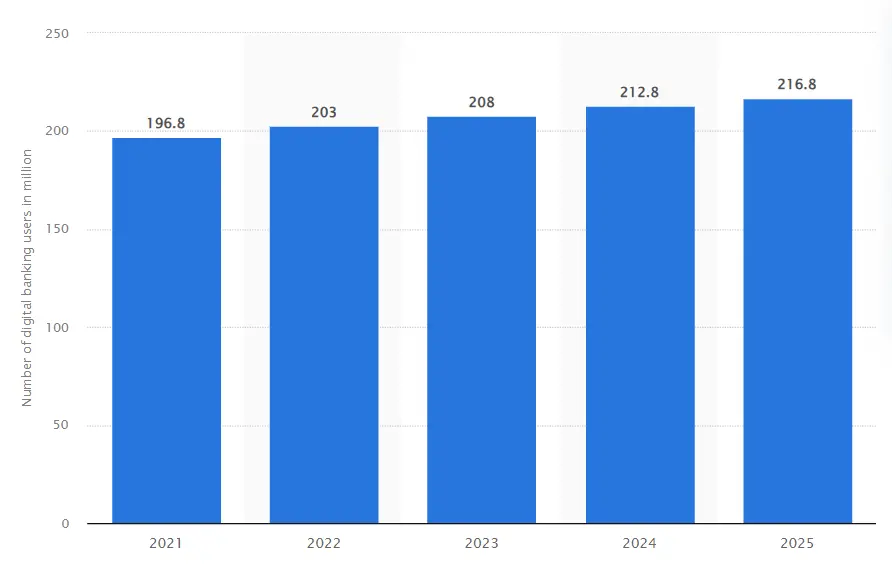

- Online banking customers in the US are predicted to rise annually from 2021 and 2025. Nearly 217 million digital banking customers are expected by 2025, up from 197 million in March 2021.

- In the US, 43.5 percent of families with bank accounts used mobile banking as their main way to connect in 2021.

- Over 805 million people have used internet banking in the Asian continent and China in 2020.

- In the USA in 2022, the most important aspect of the mobile banking app was being able to see the cash value.

- A study from Statista says that 83% of those surveyed in Korea did their banking on their smartphone or computer.

Revolutionize Your Digital Banking App With Our Top-notch Banking App Solution!

Benefits of Mobile Banking Technologies for Businesses and Consumers

Mobile banking has transformed the financial experience for consumers and businesses. Users have quick access, better financial management, and greater security, making banking easier and personalized. Businesses benefit from reduced operating costs, better processes and more customer insight. As mobile banking continues to evolve, end-users and companies benefit from smarter, faster, safer financial solutions.

| Category | Benefits for End-Users | Benefits for Companies |

| Convenience | Access banking services anytime, anywhere | Operate efficiently without physical branches |

| Time-Saving | Quick transactions and instant information access | Streamlined handling of customer transactions |

| Security | Biometric authentication, real-time alerts | Advanced security systems reduce fraud risk |

| Financial Management | Budgeting tools, spending trackers | Data-driven insights for better decision-making |

| Ease of Payments | Instant fund transfers, mobile payment integration | Simplified payment processing and workflows |

| Cost-Effective | Reduced paper usage, lower banking fees | Lower operational costs and staff requirements |

| Personalization | AI-driven advice, tailored offers | Targeted marketing and customized services |

| Customer Engagement | Enhanced interaction through mobile apps | Improved engagement and customer satisfaction |

Major Steps of Mobile Banking App Development

- Do Market Analysis

At Adsum Software, we began the process of creating a mobile banking app by researching the market for it. We look at our client’s app competitors and the way the industry is right now. For mobile banking development, we suggest giving close attention to the user’s culture, way of thinking, and practices.

That’s why the topic of whether to add a credit choice never came up. It is a vital feature that is needed. So, think about how the culture of the industry you’re going into will affect you.

- Build and Test Prototype

The most important step is to make a prototype. To understand the prototype, we create a prototype as a simpler form of end product. Functionality, stability, and looks-wise, the prototype is still a long way from its final form. You can try out your idea with it. Our mobile banking app developers just show it to real people, get their opinion, figure out what works and what doesn’t, and then make changes based on that information.

- Create Alluring User Interface

After conducting user surveys and getting input on the prototype, our UI/UX designing team will design a visually attractive user interface. The knowledge that they obtained during the research stage is used to inform their work. A simple and intuitive app’s design always catches the user’s eyes.

- Develop a Mobile Banking App

Choosing the development platform remains the first thing we do in the development stage. There’s not much doubt about this. When a client asks us to make a banking app for Android or iOS, we always choose Native app development over React Native since it is better. Our skilled developers start to add the crucial features and functionality in the app.

- Testing of App

Testing is a continuous activity that goes on at the same time as creation. To give just a few, our tester performs different types of testing methods that include user experience testing. The goal is to find bugs or other problems and fix them so that the app is safe, effective, and easy to use.

- Launch & Maintain

After going through some security checks, designing a simple user interface, and testing of the app, we’re eventually set to go live. But this isn’t the end of making banking apps for smartphones. When your app hits the sales floor, a new part begins. It gets used by people, which means fresh requirements come up and you have to add new functionality.

Mobile Banking Trends Shaping the Future

Mobile banking has transformed how people manage finances, with 89% of users adopting it and 97% of millennials actively relying on banking apps. The growth is fueled by technology-driven innovations that make banking more convenient, secure, and efficient. Banks and fintech companies are focusing on enhancing user experience, improving accessibility, and integrating advanced features to meet the evolving expectations of consumers.

Key Mobile Banking Trends:

- Artificial Intelligence (AI): AI-powered chatbots provide personalized financial advice, troubleshoot issues, and assist users with account management. Example: JPMC’s “Chase Ask.”

- Real-Time Payments: Instant transactions are increasingly popular. Platforms like Zelle allow quick transfers between accounts using just an email or phone number.

- Digital-Only Banks & Neobanks: Mobile-first banks such as Revolut offer fast account openings, fee-free international transfers, and full financial management via smartphones.

- Voice-Activated Banking: Integration with voice assistants like Amazon Alexa enables users to check balances, make payments, and manage transactions hands-free.

- Banking-as-a-Service & API Integration: APIs allow seamless connection of multiple financial services within mobile apps for a smooth user experience.

- Blockchain Technology: Enhances transaction security, transparency, and efficiency by providing decentralized verification methods and reducing fraud risks.

Current Market Trends of Mobile Banking in 2024

Now you are well-versed with the steps of mobile banking app development, you should be aware of the future trends in it. So, as we step into 2024, there are many mobile banking trends that pop up that you need to consider before investing in a digital banking app.

- BaaS

- AI will keep on growing

- Remote & video banking

- Biometric Authentication to use the app

- Easy debt management

- Voice banking facility

- Incorporation of blockchain to streamline transactions

Discover endless potential for your financial business with a tailor-made app solution!

Crucial Features of Mobile Banking App Development

Features are a big part of any mobile app’s growth. They help bring in new users while retaining old ones. However, figuring out what features your mobile banking app will have is very important. To make your load easier, our team has created a list of features that should be incorporated in mobile banking app development.

User Panel

- User registration

- Account overview

- Bill payments

- Push notification

- Mobile deposits

- In-app call/chat

- Biometric authentication

- Customer support

Admin Panel

- User management

- Transaction monitoring

- Content management

- Analytics and Reporting

- Transaction Management

- Integration with core banking systems

3 Challenges of Mobile Banking App Development

As you already know, everything has some pros and cons. So does the mobile banking app development. So, before you build a banking app, it is essential to be aware of some challenges that might come in between the process.

- KYC Verification

KYC verification is another problem. Customers of a bank are checked to make sure they are who they say they are before or while they access your app. This process is called KYC. This is hard because there are a few excellent Risk Experts here. That means you’ll likely have to search for a single for a long time. One more helpful thing is that reputed banks will assist with the KYC process.

- 3rd Parties Integration

Contracting with outside companies often takes longer than expected, and it’s frequently completed at the very last second. It could also change the project’s schedule and slow down progress. Before they can finish integrating a third party, a dedicated development team of mobile banking apps have to function properly with counterfeit information.

Occasionally it requires an additional one or two iterations to finish the functionality. Because of this, mobile banking app developers have to rewrite a lot of code so that it works with the third-party app. It will take an extra one to two runs to finish the feature. We suggest you plan and set aside a while for integrating third parties.

- Fast-Changing Requirements

Many hours of patience and adaptability are needed to make apps for mobile banking. There is a lot of growth in the fintech business right now, particularly in the United States. To keep up with new needs and changing business principles, it’s necessary to make changes.

As soon as we start working on the mobile banking app, we understand that we need to plan the final product and its codebase so that big changes can be made quickly and easily. You should also be ready for that.

Let Adsum Software Help You in Developing Mobile Banking Apps!

Finding the right mobile app development team is important if you’re hoping to make a mobile banking app. As experts in bringing financial ideas to life, Adsum Software uses careful research, smart planning, and strong tech.

We’ve released numerous excellent MVPs over the preceding few years, always keeping customers in mind from the start.

Our entire teams do all things, from examine and design to coding and installation, so we can offer full solutions all in one place. If you want to make a digital banking app, drop us an email to find out how we may assist you make your mobile banking plan a successful product.

FAQ

1. How much does it cost to develop secure mobile banking?

The cost of making a safe mobile banking app depends on the functionality you would add in it, how complicated it is, and how many security steps it needs. So, it is better to contact a firm like Adsum Software who can give an accurate cost estimation for your project.

2. How long does it take to develop a banking app?

Depending on how complicated it is, how many features it needs, and how many tests it needs, making a banking app usually takes between 6 and 12 months. It includes planning, designing, developing, testing, and deploying are some of the most important steps.

3. Should I Create Apps For Android, iOS, Or Both?

You should do your own studies, but both are acceptable. The total market share of iOS in the United States is 59%, whereas the market share of Android is 41%. The tastes of your customers will determine which option you go with.

Let’s create a measurable impact on your business.

LET’S TALK AND GET STARTEDWe love to hear the ideas of startups and flawlessly carry them out to establish them as a Brand.

We provide a FREE CONSULTATION for 60 minutes!

Call

Call adsum.software

adsum.software

Mobile App Development

Mobile App Development

Android App Development

Android App Development

iOS App Development

iOS App Development

Web App Development

Web App Development

UI/UX Design

UI/UX Design

Dedicated Development Team

Dedicated Development Team